Amid a real estate slump in China, 600 apartments in Beijing sold out within 24 hours last month, and the remaining potential buyers, around 3,200, left the on-site estate sales office disappointedly.

This scene occurred in a property project in Beijing on December 21, the coldest day this winter, and amid a strong wait-and-see sentiment after property prices in China's major cities saw a month-on-month drop for 10 months in a row this year.

"The price of this project is 1,000 yuan lower than the average price in this district, and I do need a house now," said 29-year-old Chen Wei, who barely seized an apartment that day.

"Though I thought the price might slide further, the 11,800 yuan per sq m at this location is acceptable to me," he added.

Chen's reasoning was typical and can partly explain why the project, located outside the capital's western Fourth Ring Road and developed by Sino-Ocean Land, is so popular in an otherwise stagnant market.

In fact, the developer had increased the price by 800 yuan after selling another batch of apartments at 11,000 yuan per sq m in early November last year.

"We want to speed up the flow of operating capital," said Zhang Senlin, head of the marketing department of Sino-Ocean Land. "The most important thing for real estate firms now is to survive this round of market corrections, and cutting the price to quicken sales is an effective way to maintain a healthy cash flow."

And this is also what the government wants. In China's cabinet's latest notice on firing up the real estate sector, it urged property developers to adjust their prices to promote sales.

"What the government really cares about is the market's vibrancy rather than the price," said Qin Hong, deputy director of the policy research center under the Ministry of Housing and Urban-Rural Development.

The floor space of China's residential properties sold in the first 11 months of 2008 fell 18.8 percent from a year earlier, while real estate investment growth slowed to 22.7 percent in the January-November period of 2008, down from 24.6 percent in the first 10 months of last year, according to the National Bureau of Statistics.

The property sector is one of the biggest drivers of China's domestic consumption, contributing a quarter of fixed-asset investment and employing 77 million people.

The government has launched a slew of measures to try and recharge it in the past few months, such as cutting property transaction taxes and slashing mortgage rates.

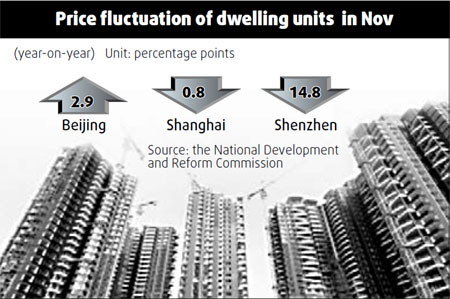

Thanks to those stimuli, major property markets in China's 12 cities, including Beijing, Shanghai and Shenzhen, have shown signs of warming up.

According to statistics from Beijing Transaction (bjfdc.bjjs.gov.cn), 13,721 forward delivery houses were contracted online in November 2008, up 48 percent month-on-month. In September, only 100 houses were sold each day.

The big jump in last November's property transactions, however, was largely attributed to "affordable housing" for medium and low-income homeowners (in Bejing that means a family of three making 45,300 yuan or less per year). Among the forward delivery of house sales in November 2008, about 55 percent were deals for such homes.

Statistics from the Shanghai UWIN Real Estate Research Center show that 6,201 new apartments with a total floor area of 717,551 sq m were sold in Shanghai in November 2008, compared with 459,764 sq m in the previous month.

Shenzhen doubled its property trading volume in November 2008, but the prices dropped further. According to statistics from the Chinese Property Index Research Institute, 6,039 apartments were sold , up 73 percent month-on-month. The average price, however, dropped by 4.48 percent to stand at 12,506 yuan per sq m.

But experts believe that the property market still needs more time to usher in a real spring.

"It needs at least a quarter to judge whether the trend of the property market is getting better or worse," said Yang Hongxu, head of the Comprehensive Research Department of the E-house China R&D Institute. "A one month bounce is not enough."

(China Daily January 5, 2009)