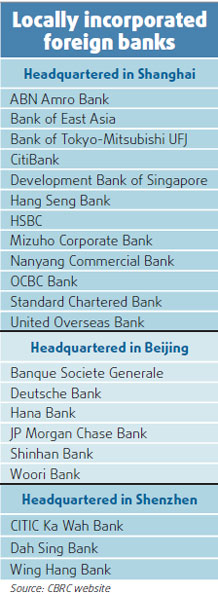

Over the last two years, 30 foreign banks have incorporated in China, competing directly with Chinese banks in a number of services.

![A man walks past advertisements of financial institutions on Financial Street in Beijing. [China Daily] A man walks past advertisements of financial institutions on Financial Street in Beijing. [China Daily]](http://images.china.cn/attachement/jpg/site1007/20090108/001109b42f730acfb30b1c.jpg) |

| A man walks past advertisements of financial institutions on Financial Street in Beijing.?[China Daily] |

But KPMG, one of the world's leading auditing firms, warned in a recent report that many foreign lenders have still not developed sufficient local controls over their business. Relying too heavily on the parent bank to supervise compliance can result in overlooking certain local compliance requirements, it said.

Foreign banks seeking to incorporate in China are entering the market at an extremely challenging time in the country's development. Even before the worst of the current crisis, according to KPMG, some banks underestimated the financial commitment involved in incorporating in China, or struggled to get the necessary commitment from their head offices. Now, securing such necessary approvals and resources may be even more of a challenge, as rising prices and market volatility influence the direction of regulatory policy.

As the financial crisis gets worse, banks are likely to see a trend toward more rather than less regulation. And the implications will be felt strongly by foreign lenders.

"On the regulatory front, rising prices and market volatility are driving the direction of government policies. After the credit crunch, regulatory bodies will opt for greater transparency and stricter regulations," said Edwina Li, financial services partner at KPMG China.

"China has been following the world's best practices and foreign banks seeking to incorporate locally will face rising compliance pressures."

Stricter regulations are also likely to create increased cost pressures for management.

The current financial crisis is not the only concern cited in the report. For instance, while foreign banks are seen as attractive places to work, they often suffer a high staff turnover rate.

Senior management, compliance specialists and wealth management experts at overseas banks are all highly sought after and efforts to incorporate can be jeopardized if key management leave or additional human resources cannot be found.

KPMG also highlighted risk management and local IT systems as two major challenges.

As risk management is a relatively new concept in China, experienced risk control managers and analysts can be hard to find, the reports said. Importing foreign expertise is one option, but banks may find it more beneficial to have predominantly local staff run risk management in the long term.

Also, banks face problems given that customer credit records will take time to assemble. "Banks can find that there are insufficient credit records for both corporate and retail customers, and localization issues related to risk management procedures and policies," Li said.

Foreign banks need to adjust their own credit and operational risk frameworks to the relevant Chinese regulations.

In areas such as anti-money laundering, overseas lenders might assume their parent banks' policies are sufficient, but in some areas, China's restrictions and requirements may be more stringent than those of their home markets.

The report also noted the increased cost of employing IT managers.

"A critical factor is the need for foreign banks to build up a local IT team, as they will be under pressure to adapt to the local market and business requirements in the course of network expansion in the country," said Simon Gleave, partner in charge at financial services department of KPMG China.

The report, which features several case studies, also views private banking, renminbi retail banking and derivatives as three strong areas of potential growth for foreign lenders in China.

(China Daily January 8, 2009)