Bus maker Zhengzhou Yutong Bus Co Tuesday posted a 37 percent rise in 2008 net income on healthy investment returns, but warned that revenue may shrink considerably this year due to the global financial turbulence.

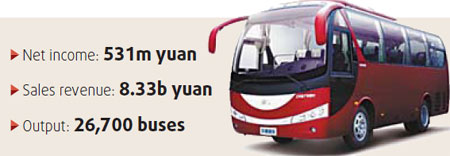

Net income for 2008 rose to 531 million yuan, or 1.02 yuan per share, while sales revenue rose 3.5 percent from a year earlier to 8.33 billion yuan, the Shanghai-listed firm said.

Yutong shares rose nearly 7.58 percent to close at an eight-month high of 13.62 yuan in Shanghai yesterday.

The bus maker said it made a profit of 253 million yuan, or 48 percent of its total net income, by selling its 51 percent stake in a subsidiary property firm to its parent Zhengzhou Yutong Group in March 2008.

The company produced 26,700 and sold 27,600 buses last year, up 2 percent and 8 percent from a year earlier respectively.

Yutong said it expects to post a sales revenue of 7.58 billion yuan this year, 9 percent lower than last year.

"As a result of the global financial crisis, the international market is likely to remain in doldrums this year and the slowing national economy will also dampen domestic bus demand," Yutong said.

Yutong, which now holds more than one-fifth of China's bus market, said it aims to reduce its costs by 8 percent this year to 7.21 billion yuan from 7.86 billion yuan last year.

"The company's 2008 performance has been steady and healthy," Huatai Securities said in a research note.

Yutong sold 24,254 medium- and large-size buses last year, up 2 percent from a year earlier, the company said, which analysts said is an encouraging trend.

"The proportion of medium- and large-size buses in its overall sales has risen slightly in the last year, which is an increasingly optimized sales structure," said Yi Junfeng, analyst, Changjiang Securities.

Yutong's profitability is expected to improve as raw material prices have been falling recently, analysts said.

The company's gross profit margin, which has dropped in the first three quarters, rebounded to 20 percent in the fourth quarter, the highest last year, Huatai Securities said.

"The low raw materials prices will help the company to maintain its relatively high gross profit margin seen in the fourth quarter last year," Huatai said in a research note.

"As the bus industry still remains lackluster this year, Yutong is likely to outperform its peers," Huatai said, giving a 'buy' recommendation on the company.

(China Daily April 8, 2009)