China's largest refiner Sinopec is considering an US$8 billion bid for the Geneva-based oil and gas producer Addax Petroleum Corp.

The Beijing-based Sinopec is in preliminary talks with Addax for the acquisition. The deal could be worth as much as US$8 billion, domestic media reported, citing unnamed sources with the company.

Simopec spokesman yesterday declined to comment on the deal, but said the company is in talks with "several overseas companies for possible deals".

Addax, which is based in Geneva but lists its shares in Toronto and London, said in a statement "it has held preliminary discussions with third parties expressing an interest in a potential transaction with the corporation." The company did not elaborate.

Domestic media also reported that China's two other major oil companies, PetroChina and CNOOC, have also evinced interest in a deal with Addax.

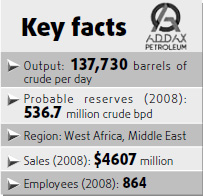

Addax's oil and gas assets are mainly based in West Africa and the Middle East, with core assets in Nigeria. The company said it produced 134,730 barrels of oil a day in the first quarter, with more than three quarters of its output coming from properties in Nigeria.

At present PetroChina, Sinopec and CNOOC all have operations in Nigeria, and Sinopec is a partner in one of Addax's properties in the country.

Analysts said the Addax deal shows that Chinese oil companies are working to accelerate their development in Africa, an area with rich oil and gas reserves.

In another development, China's third largest oil company CNOOC is reportedly planning a bid of as much as $4 billion for the principal assets of US-based Kosmos Energy LLC, which is selling its 30 percent stake in the Jubilee oilfield off the coast of Ghana.

"The timing is good for domestic oil companies to make overseas deals as they can buy assets for cheaper prices," said Lin Boqiang, director of the China Center for Energy Economics Research at Xiamen University. "Compared with $147 per barrel last July, crude prices have fallen by over 50 percent."

PetroChina Chairman Jiang Jiemin, had earlier said the company "would take advantage of the relatively low oil price to make sizable and sustained growth in its overseas operations".

Overseas mergers and acquisitions will be a key strategic development target for the company. PetroChina will boost cooperation with national oil companies in resource-rich countries such as Kazakhstan, Venezuela and Qatar this year, said Jiang.

(China Daily June 11, 2009)