ABC plans 150b yuan public float

Agricultural Bank of China (ABC), the only bank among the Big Four State-run lenders yet to float shares, is planning to raise up to 150 billion yuan through a dual listing in Shanghai and Hong Kong as early as April this year, people with knowledge of the matter told China Daily.

Agricultural Bank of China (ABC), the only bank among the Big Four State-run lenders yet to float shares, is planning to raise up to 150 billion yuan through a dual listing in Shanghai and Hong Kong as early as April this year, people with knowledge of the matter told China Daily.

The nation's third largest lender by assets plans to issue some 50 billion shares in the Shanghai and Hong Kong bourses, with an indicative price of about 3 yuan for the Shanghai A share, said the source, who did not want to be identified due to the sensitive nature of the matter.

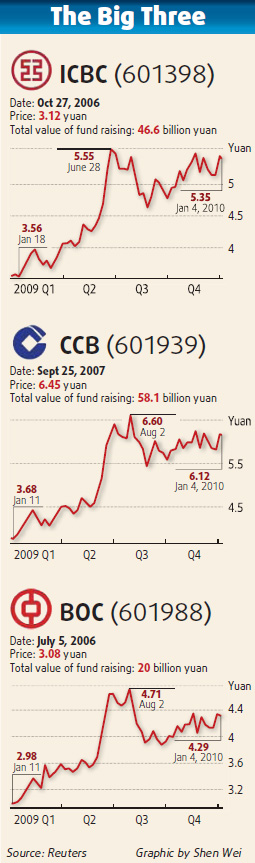

The hefty size of the much-awaited IPO of ABC is comparable to the record-setting $21.9 billion share float of Industrial and Commercial Bank of China (ICBC) in 2006 and surpasses the 120 billion yuan and 100 billion yuan raised by China Construction Bank (CCB) and Bank of China (BOC) between 2005 and 2007.

"The specific amount of shares to be floated in the Shanghai and Hong Kong bourses is yet to be decided," the source said, but indicated that the Shanghai float would be bigger than Hong Kong.

ABC has been under the market glare for some time now as its restructuring and eventual listing will complete the decade-long reform of the Chinese banking industry, which has cost the government billions of dollars to wipe out the massive bad debts on the balance sheets.

Sources indicated that the nation's pension fund might invest some 20 billion yuan in the bank. However, apart from the fund, ABC has failed to forge strategic partnerships with other financial institutions from both within and outside the country, the source said.

"The social security fund is the only strategic investor that the bank will bring in before its IPO," the source said, adding that the two entities aimed to set up a long-term partnership and would look for ways to cooperate on future business developments.

This is a far cry from the other three listed major State-run lenders - ICBC, CCB and BOC - all of which have brought in a number of foreign financial entities as strategic investors, including Goldman Sachs, Bank of America, UBS, and Royal Bank of Scotland, before their IPOs for cooperation as well as expertise in corporate governance and risk control.

ABC specializes in serving the nation's 800 million farmers and is considered the weakest lender among the Big Four banks. Its plan to introduce foreign strategic investors ran into rough weather after the global financial crisis saw most Western financial institutions putting off their plans and in some cases selling or reducing their stakes in Chinese lenders.

ABC received a $19 billion capital infusion in October last year from Central Huijin, the domestic investment arm of China's sovereign wealth fund, making it 50 percent owned by the latter. The Ministry of Finance owns the other half.

0 Comments

0 Comments