EU's massive bailout to affect China

A nearly $1 trillion rescue package to prevent the Greek sovereign debt crisis spreading in Europe will impact on various facets of the Chinese economy, analysts have said.

A nearly $1 trillion rescue package to prevent the Greek sovereign debt crisis spreading in Europe will impact on various facets of the Chinese economy, analysts have said.

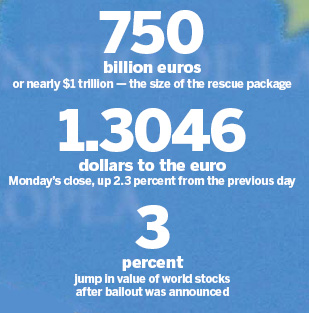

The deal agreed earlier on Monday pledged $670 billion of loans and loan guarantees to any euro zone country needing funds, plus about $322 billion from the International Monetary Fund (IMF).

The aim is to keep the euro currency from being torn apart and derailing the global economic recovery.

Markets cheered the news with world stocks rising nearly 3 percent. Global stocks as measured by MSCI were up 2.8 percent with its emerging market-only counterpart jumping more than 3 percent.

The euro gained nearly 2 percent on the US dollar.

In China, the benchmark Shanghai Composite Index gained 10.38 points, or 0.4 percent while in Hong Kong, the Hang Seng Index rose 506.35 points, or 2.54 percent, to finish at 20,426.64.

In Europe, oil prices rebounded from last week's 14 percent sell-off, rising to $78 a barrel.

But Chinese analysts said the country faces uncertainties in its overseas financial portfolio, exports, currency policy and exit from the economic stimulus package.

"The rescue package will help the markets regain confidence and alleviate panic about not only the Greek economy, but also other European economies," said Zhang Xiaoji, senior economist with the State Council's Development Research Center.

"The deal will help create a stable economic environment and will help reduce people's concerns that it will lead to a double dip recession in Europe," said Stephen Joske, director of the China forecasting service at Economist Intelligence Unit.

Premier Wen Jiabao told Spanish Prime Minister Jose Luis Rodriguez Zapatero on Monday that China supports action to help Greece overcome its sovereign debt crisis. Spain currently holds the rotating presidency of the EU.

In a telephone conversation with Zapatero, Wen urged countries to coordinate economic policymaking, reform the international financial governance structure, maintain stability of currencies and prevent protectionism.

But it is too early to suggest the European situation has stabilized, said Yu Yongding, head of the China Society of World Economics.

"The Greek crisis fully exposed the weakness of the global economic recovery," Yu, a former member of the central bank's monetary policy committee, told China Daily. "It is hard to predict what will happen next."

The euro will probably remain weak, Yu said, while the dollar will strengthen.

"It will pose a challenge for China's policymakers, who want to diversify the country's overseas financial portfolio," he said.

China has spent the bulk of its foreign exchange reserves on dollar-denominated assets, such as US treasury bonds. It has been pondering diversifying the structure of investment.

"But now it is clear that the euro also has risks," Yu said. "It would complicate China's policymaking."

China's exports are set to suffer, Yu said, since the crisis would be a drag on the growth of Europe, China's largest trade partner. "Growth is no longer the top priority for crisis-hit countries; they have to first repay their debt and convince investors they are capable of doing that."

The impact on China's exports, however, could be limited, said Zhang at the State Council's Development Research Center.

"The weakened euro will affect trade settled in euros, but the majority of China's trade with European countries is settled in US dollars," he said, adding that China's previously announced export target of 10 percent year-on-year growth for this year should not necessarily be changed.

One outcome of the European crisis is that China is facing less pressure for the yuan's revaluation as the US dollar is rising. But the dollar's rise could damage US exports, which US President Barack Obama wants to double in five years.

"Therefore, the US could press harder for the yuan's appreciation to benefit its export sector," Yu said.

China will "improve the yuan's exchange-rate formation mechanism", but the yuan would remain "basically stable", the People's Bank of China said in a quarterly report on Monday.

Yu also said China's current monetary policy, which is tightening, should not be changed despite the external uncertainties brought about by the European crisis. "We should not rush to change it given the excessive money supply growth and high asset prices."

By doing that, he said China's economic growth rate should slow this year.

China International Capital Corporation cut its forecast of China's year-on-year growth for this year to 9.5 percent from 10.5 percent in its report released on Monday, citing the country's tightening measures and external uncertainties caused by the Greek crisis.

0

0