China leads global IPO market in 2011

- By Ke Wang

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, December 22, 2011

E-mail

China.org.cn, December 22, 2011

China's exchanges continued to lead global IPO activity in 2011, representing 40 percent of total capital raised worldwide this year, U.S. accounting firm Ernst & Young said at a press conference Wednesday in Beijing.

From Jan. 1 to Dec. 21, IPOs in China raised a total of US$67.9 billion, the company said. Experts estimate 410 deals will be closed by the end of December, which will bring the total amount of capital raised to US$79.3 billion by year's end.

If estimates prove correct, the figures will still represent a 42 percent decline in funds raised compared to 2010.

Globally, US$155.8 billion has been raised from IPO offerings this year, Ernst & Young reported, with estimates expecting funding to hit US$170 billion by the end of 2011, a 40 percent decline year-on-year from 2010 but still 50 percent above 2009 totals.

Sophie Chen, assurance partner at Ernst & Young, said after a promising start in the first two quarters of 2011, global IPO activity dropped dramatically in the second half of the year. Investors remained concerned about sovereign debt issues in Europe and Standard & Poor's downgrading of the US credit rating, Chen said.

"The negative influence caused by Japan's earthquake early this year, Standard & Poor's downgrading of US credit rating and the uncertainty around the unanimous resolution around the Euro zone debt crisis, all these factors have left investors and issuers with a lack of confidence," she said.

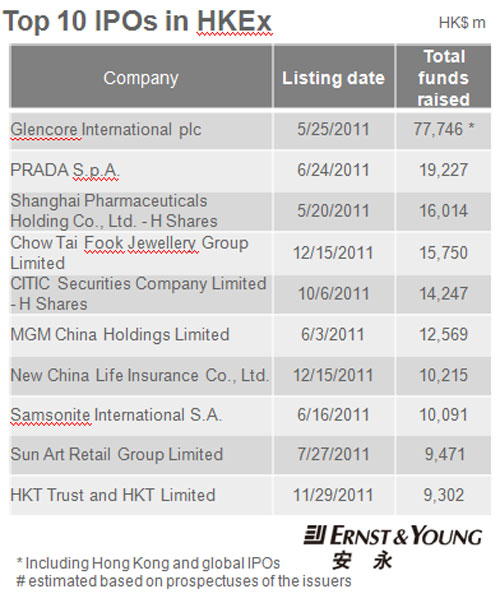

The largest IPO on Chinese exchanges this year was the US$10 billion listing of Glencore International on the Hong Kong Stock Exchange (HKEx), followed by the US$2.5 billion Prada SpA listing. Strong year-end finish for China IPO market.

Chen said a big wave of Hong Kong IPOs in December helped the HKEx end 2011 with a strong finish, as issuers made use of the less volatile capital market to complete their IPOs before the year end.

The Shanghai Stock Exchange (SSE) ranked fourth in global capital raised in the first eleven months of 2011. Chen also indicated that the number of IPO deals on the NASDAQ-like ChinNext exchange this year reached 128, creating the record high and for the first time exceeded the SME exchange.

Terence Ho, strategic growth markets leader of Greater China at Ernst & Young said China has been a key engine for the IPO resurgence following the global economic downturn which began in 2008.

"In 2010, China exchanges led the world in bringing new companies to market, this trend continued in 2011 with HKEx, Shenzhen Stock Exchange (SZSE) and SSE among the top five exchanges by capital raised," he said. "With a big wave of IPOs in December, the HKEx will co-lead global exchanges by IPO funds raised in 2011 with the New York Stock Exchange with US$33.4 billion." Outlook for 2012 remains strong

Ernst & Young pointed out many companies are waiting in the IPO pipeline and will go public once the capital market stabilizes.

For HKEx, the company forecasted total IPO value in 2012 will reach US$35 to 36 billion. Value will come mainly from sectors like retail and consumer products, financials, industrials and resources.

Meanwhile, A-Share IPOs will remain active and are expected to raise a large amount of capital in 2012, with the SZSE playing a major role. Experts expect another IPO wave to surface in the first half of 2012.

Edward Ho, managing partner of Assurance Services Greater China at Ernst & Young, said more companies from the entertainment and media sectors will apply for listings, thanks to the Chinese government's support in raising funds from the capital market for future growth.

"Although market uncertainty still exists, new IPO filings will continue to increase globally and a large accumulation has built up as companies wait for greater macroeconomic stability," Ho said.

Ho stressed the key to IPO market recovery lies in the speedy resolution of the European debt crisis. "It will not only stabilize the global capital market, but also rebuild investors' confidence," he said. "The fast growing companies view IPO as a way to raise capital and as the heart of their growth strategies."