Stock losses limited by late flood of buy orders

0 Comment(s)

0 Comment(s) Print

Print E-mail China Daily, June 26, 2013

E-mail China Daily, June 26, 2013

A flood of buy orders in the late afternoon narrowed losses at the Shanghai Stock Exchange on Tuesday to 0.19 percent at the close from its nadir of 5.7 percent earlier in the day.

Turnover increased 13.6 percent to over 100 billion yuan ($16.26 billion) from the 88 billion yuan registered on the previous trading day. The increase was largely attributed to the flurry of late orders.

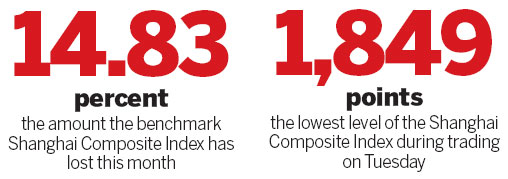

It's not clear where the buying was coming from, but stockbrokers and analysts said that major investors are obviously trying to stabilize the market, which has fallen 14.83 percent since the beginning of the month.

Zhang Qi, a senior analyst at Haitong Securities Co Ltd, said that most of the buying was focused on banks and brokerage companies, which together account for about 25 percent of the exchange's weighting.

It's possible that institutional investors, including Central Huijin, an arm of China's sovereign wealth fund, mounted a rescue operation to stop the recent market bloodbath, analysts said.

Zhang added that these investors must have thought that stock prices had sunk low enough to enable some "bargain hunting".

Whatever the motive, these investors were seen by many in the market as the knights in shining armor who saved the day. A drop in share prices shortly after the opening pushed the Shanghai exchange down to its low level of 1,849.65 points.

The bloodbath following Monday's rout has so shaken investors' confidence that Hong Hao, chief strategist at Bank of Communications International Securities Co Ltd, said in a Reuters report: "This is a market in capitulation."

The dramatic turnaround in the late afternoon also led to a rebound in the stock prices of the four State-owned banks. Industrial and Commercial Bank of China Ltd rose 1.54 percent, Agricultural Bank of China Ltd was up 1.21 percent, Construction Bank of China Ltd increased 0.76 percent and Bank of China Ltd rose 1.18 percent.

Tuesday's star performers were the so-called "financial reform" stocks. For instance, all the four stocks related to the financial reform efforts in Wenzhou, Zhejiang province, jumped by the daily 10 percent limit. Those stocks are: Sunny Loan Top Co Ltd, Jinshan Development & Construction Co Ltd, Zhejiang Dongri Co Ltd and Jinfeng Investment Co Ltd.

Meanwhile, the smaller Shenzhen Stock Exchange's main board dropped 1.23 percent to close at 7,495.1 points after an earlier plunge.

Hong Kong's benchmark Hang Seng Index was up 0.21 percent on Tuesday to close at 19,855 points, while the Nikkei 225 Index decreased 0.72 percent to close at 12,969.34.

Since early June, the stock market has been posting losses despite a slight 0.52 percent recovery seen on June 21. A total of 3.47 trillion yuan have been wiped out of China's A-share market.

Wang Jianhui, chief economist at Southwest Securities Co Ltd, said that the recent losses were largely due to panic selling without much technical support. He predicted that the decline will come to an end at the beginning of July since the payment period for wealth management products will finish by the end of June and interest rates are likely to go down.

"It's too early to say that Chinese shares have been dragged to a bear market," he said.

Also, the recent price adjustments were triggered by investors' recognition of the government's economic restructuring policies, Wang added.

"There's not a lack of capital, the only problem is a lack of liquidity. It's evident that the central government wants to restructure the system via regulatory measures. But it seems that the markets, be it the interest rate market or the stock market, are not yet prepared for the regulations," he said.

Regarding long-term investments, Wang suggested the banking and real estate sectors due to their good fundamentals. In addition, the consumption, retail, transportation, logistics and power sectors also have much room for growth, he added.