The specter of deflation is fading even though consumer and producer prices have continued to fall, economists said Monday.

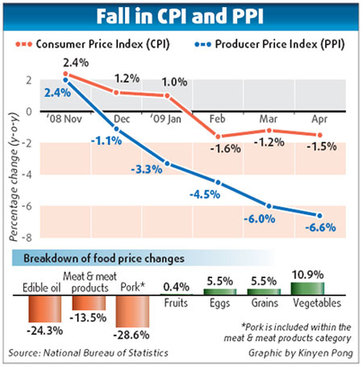

The Consumer Price Index (CPI), a key gauge of inflation, fell 1.5 percent in April from a year earlier, the third straight month of decline.

The index declined at a quicker pace in April, the National Bureau of Statistics said Monday. The drop was 1.2 percent in March.

The Producer Price Index (PPI), which monitors factory-gate price changes, slid for the fifth month, dropping 6.6 percent in April from a year earlier, compared with 6 percent in March.

"Although the indices continued to see negative growth in April, deflationary concerns appear to be subsiding as the economy shows signs of recovery," said Jing Ulrich, chairman of China equities at JPMorgan.

Analysts said the fall of the indices is not as worrisome as it appears because of their high reference point - sharp rises in the prices of food and raw materials last year and their subsequent fall in the early months of this year.

For example, pork prices plummeted 28.6 percent in April from a year earlier. And crude dropped 53.6 percent, despite a recent rally on global markets.

"As the economy continues to recover and credit growth continues to expand, consumer prices should show an uptrend in the second half of the year," Ulrich said.

Over the past months, there have been signs that the economy has bottomed out. Strong loan growth and the government's US$586-billion stimulus package are expected to prop up investment and help offset the impact of shrinking exports, which have long been a growth engine.

Banks extended 591.9 billion yuan (US$86.3 billion) in new loans in April, up 27.1 percent from a year earlier. That put new lending for the first four months at 5.17 trillion yuan, more than the figure for the whole of last year.

M2, or the broader measure of money supply, surged 25.95 percent by the end of April, compared with 17.82 percent for 2008.

Analysts say the lion's share of the loans went to government-backed infrastructure projects in the stimulus plan. That would help revive demand and stabilize the prices of industrial products in the coming months.

Meanwhile, there are few signs of deflationary expectation among consumers, as sales in housing and car markets have rebounded.

Frank Gong, chief economist at JP Morgan, said in an earlier interview that deflationary expectation was a major threat for economic recovery, as it would mean consumers delay spending.

Auto sales rose 24.97 percent in April to 1.15 million units, hitting a fresh record and making the country the world's largest auto market for the fourth consecutive month, the China Association of Automobile Manufacturers reported last week.

Housing sales also rebounded. Industry specialists say sales volume in Beijing, Shanghai and Shenzhen grew more than 100 percent in the first quarter from a year ago.

Sun Mingchun, an economist with Nomura International, said the government's stimulus measures and strong loan growth would push up PPI and that, in turn, would lead to a higher CPI. He expects China's CPI to rise 2.3 percent in the fourth quarter year on year.

(Xinhua News Agency May 12, 2009)