|

|

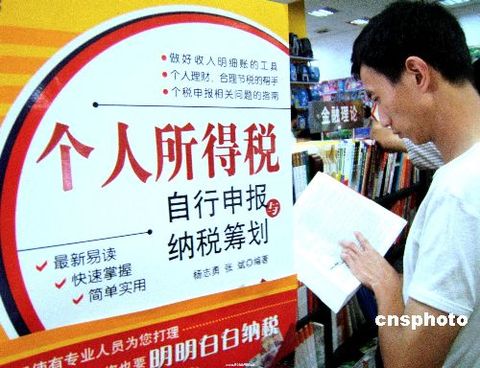

| File photo: The proposed amendments to China's individual income tax laws prompted a diverse response from the general public over the past month, after the suggestions were posted online to solicit opinions. |

The proposed amendments to China's individual income tax laws prompted a diverse response from the general public over the past month, after the suggestions were posted online to solicit opinions. The attention and debate were mainly focused on threshold levels, as well as other aspects of the current system, to strengthen the function of taxes in narrowing income disparity. CCTV Reporter Liu Ying reports.

As of May 31st, the deadline for soliciting public opinion on the proposed amendments to individual income tax laws, a record number of more than 230-thousand comments were posted on the website of the National People's Congress, China's top legislature.

Although the details of the comments have not been released, much of the attention is believed to focus on the proposed increase in the tax exemption threshold, from the current two-thousand yuan per month, to three-thousand yuan.

"Lawmakers say the aim of the amendments to the individual income tax law is to reduce the tax burden on low and middle income groups, and make individual income tax a more effective tool for adjusting income distribution. It's estimated that about 95 percent of taxpayers will benefit from the adjustments, while 3 percent, mainly the rich, will see their tax obligation increased. But despite this, it seems most people are still not content with the proposed increase in the threshold level. Many want to see high-income earners pay more tax." CCTV Reporter Liu Ying said.

Tax Payer, Beijing, said, "I think the 3,000 yuan threshold is too low. Considering the high housing prices and rising consumer prices, I think the threshold should be raised to 5,000 yuan."

"It's a good thing for the government to decide to raise the tax exemption threshold. But I think the government needs to do more to supervise taxation on the rich." Tax payer in Beijing said.

Such opinions are echoed by a number of experts. In a survey conducted by Internet portal Netease.com, 70 of 100 economists questioned said the 3,000 yuan threshold is too low, and 54 regarded 5,000 yuan as a fairer level.

Yang Zhiyong, from the Chinese Academy of Social Sciences, suggests the tax threshold should be tied to consumer price increases. He also thinks the current rates should be lowered even more.

Yang Zhiyong, Research Fellow of CASS Institute of Finance & Trade Economics, said, "I think the 3,000-yuan threshold is reasonable. It reflects price increases since the last adjustment was made in March 2008. But I think it's necessary to establish an automatic tax threshold adjusting mechanism so that, when prices rise to a certain level, the threshold will be increased accordingly. In addition, I think overall tax rates should be substantially lowered, to more effectively provide tax relief."

Another major concern being debated among the public focuses on taxation of the rich, which is widely perceived as a great weakness of the current system.

"I believe it's more important to step up the tax levy on high-income earners. Much income among this group consists of non-salary earnings. And many of their transactions are made in cash, which is not easy to track. There are a lot of holes in the taxation of this part of people's revenue. This damages the fairness of the tax regime even more." Yang said.

Many experts say the proposed amendments to the individual income tax law don't do enough to adjust income distribution, given the many defects in the current system. Some even suggest a complete overhaul, rather than minor modifications, to make the regime function more fairly and effectively than ever.

(CNTV June 1, 2011)