Get ready for liquidity flood

- By Sun Qing

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, April 30, 2012

E-mail China.org.cn, April 30, 2012

I don't know whether the rising costs of everyday commodities have already caught your attention, but I can assure you this year you will.

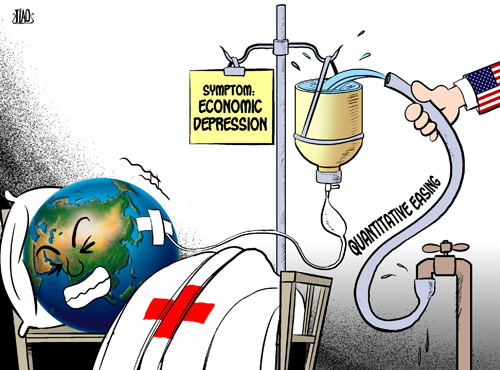

Just look at the recent practices by central banks across the globe, with more and more emerging countries lining up alongside advanced economies to implement quantitative easing policies. As all these countries inject liquidity into the market, they bet on the chance for growth at the cost of certain rises in their consumer price indices.

|

|

|

Snow plus frost [By Jiao Haiyang/China.org.cn] |

April seems a magical time for the world's central banks. After an assessment on the global and domestic economic conditions, emerging countries have began cutting interest rates - among them, India by 0.5 percent, and Brazil by 0.75 percent. China will possibly follow suit at the end of the month.

It's quite obvious that the emerging countries are leading this round of rate cuts, is this positive sign?

While it may not necessarily be a positive sign that emerging countries are leading this round of rate cuts, it is a direct and effective way - in the short term - to boost growth, when few central banks can be certain of the direction of the market.

Let's take Brazil for example, as it contains all characteristics of a typical emerging country. Brazil's economy has been slowing since 2011. One of the reasons behind this downward trend is the sluggish global economy, but on the other hand, its capital is too expensive, peaking at 12.5 percent SELIC rate and squeezing out a number of private investments. At the same time, the spread between its high interest rate and low rates in advanced economies (0-2.5 percent in the U.S.) attracted a large amount of foreign capital, creating great volatility and fluctuation for its capital market. Furthermore, the strength of Brazil's currency impeded exports, which combined with wanting to reduce volatility makes it quite reasonable that the central bank decided to cut interest rate.

Similar in India and China, the two countries suffered high inflation after stimulation measures in 2008-09 that raised interest rates and increased capital costs. Now, the side effects are in full display, and many enterprises cannot afford to borrow or even attain loans from banks. At the same time, owing to the gloomy economic climate in advanced economies, exports are declining together with foreign investment. To supplement this liquidity shortage, rate cuts will be effective.

But these moves to boost growth have their own downsides: Too much liquidity generally means higher inflation, especially considering the already high CPI figures in emerging countries like these three countries. Brazil posted a March CPI of 5.2 percent, much higher than its target this year of 4.5 percent. In India, its current CPI figure is 6.89 percent. China set 4 percent as the ceiling for 2012, and things are not looking much better there. With forced growth with injecting liquidity, inflation is the other side of the seesaw.

Even as emerging countries dominate this round of liquidity injection, advanced economies have no intention to be left behind. Canada, Sweden and the U.K. announced they would keep low rates at least through 2012, and the U.S. will maintain it until 2014. In addition, the Bank of England is expected to start another round of QE worth 25 billion pound. The Bank of Japan will likely inject 1 trillion yen. The European Central Bank is mulling similar plans. Elsewhere, many are expecting Australia to cut interest rates to 4.25 percent.

With all these major global actors, whose GDP total 90 percent of the world economy, injecting liquidity into the market, they could temporarily lift the world economy out of the current trap with the cost of another round of high inflation. Ultimately however, a broken wheel cannot be fixed by adding more grease. It needs a much more fundamental revamp.

As things stand, don't keep your money under the mattress. Take advantage of the liquidity flood and invest before capital value shrinks with the speed of the surging CPI.

The author is a financial journalist mainly covering international finance and fiscal policy.

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.