High price of informal financing

|

|

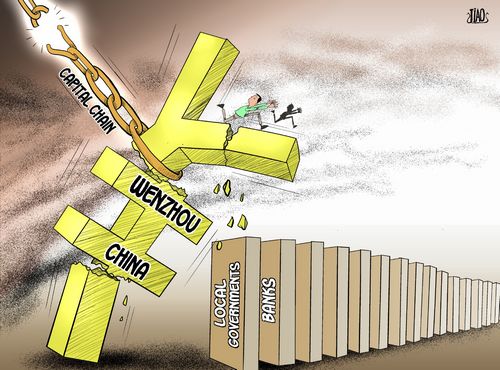

The first domino [By Jiao Haiyang/China.org.cn] |

The coal-rich city of Erdos in the Inner Mongolia autonomous region is bathing in the revelry of private borrowing at present. As an important supplier of natural resources in China, Erdos' average GDP per capita already exceeds that of Hong Kong. Almost every family in the city owns property there.

Private enterprises' hunger for cash flow in the tightening fiscal environment coincides with the abundant private capital in Erdos and as the city has prospered, pawnshops, small-loan companies and agencies for private equity funds have proliferated everywhere in the city. They attract savings with a high interest rate and lend the money to enterprises at a much higher rate than the banks.

The overall private capital is estimated to be more than 100 billion yuan ($15.75 billion). The monthly interest rate is about 2 to 3 percent. That is to say, an annual rate of 24 to 36 percent. But the gross profit rate of medium and small-scale enterprises is hardly 10 percent now, which means such private borrowing will be unbearable for them in the long run.

Zhejiang province is also famous for its robust private banking sector. Private borrowing supports speculators in the city of Wenzhou in the fields of real estate and coal, reaching an estimated total of 100 billion yuan.

But there is no free lunch, and some businessmen in Wenzhou have been forced to run away to evade their creditors. Nine bosses escaped from debts in one single day on Sept 22. Some of them owe hundreds of millions or even billions of yuan to their creditors. It is a warning sign of the possible collapse of private borrowing and a preview of Erdos' future.

The capital market of China is basically State-owned, making it very difficult for private business to get direct financing. China's banks favor large enterprises, especially State-owned ones, because banks try to lower their risks and seek a guaranteed return on their capital. Although some State-owned enterprises' efficiency is remarkably low, the banks are still willing to provide them with favorable interest-rate loans, causing further uneven and irrational distribution of capital.

In contrast, it is more difficult for medium and small-scale enterprises, especially private businesses and individuals, to borrow from banks. So they must turn to the private borrowing market for financing, which necessarily promotes private usury.

Moreover, this lucrative private usury has already attracted capital from industry to the private borrowing market, undermining the foundation of industries and turning private borrowing into a castle in the air. Once one link of the chain breaks, the damage will have a domino-like effect, dealing a heavy blow to the local economy and social stability.

Thus, private borrowing needs to be regulated. Jiangshan city government in Zhejiang province has already banned Party members and civil servants from being involved in private loaning businesses. And authorities in Wenzhou issued a joint notice calling for banks to improve their financial support for medium and small-scale enterprises. Although these measures are positive, a cure to the problem entails systematic reform.

Private capital should be guided rationally to proper outlets, as well as to industrial sectors currently under State monopoly. More and more private capital will be able to flow in, which will reduce private businesses' reliance on external financing and promote the healthy development of the financing market.

Commercial banks with State holdings should also extend their helping arms more to non-State enterprises. If more and more market elements can be introduced into the financing field, it will be easier for medium and small-scale enterprises to borrow from regulated channels as capital sources are increasingly diversified. In this way the soil in which illegal and disorderly private borrowing flourishes will be eradicated.

The author is a Shanghai-based economic commentator.